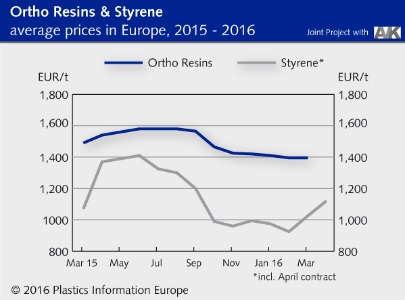

In March, a few high-standing ortho resins notations were corrected downward, but the vast majority were still caught in a rollover, due to the decline in demand ahead of the Easter holidays. The PIE range tended sideways. The EUR 100/t rise in the styrene contract at the beginning of the month put producers on alert but otherwise had no consequences.

The situation is due to change over the course of April, when demand gets back into full swing again after the Easter holidays. In addition to producers’ calls for price increases averaging EUR 80/t to reflect the higher cost of styrene, momentum could arise from the tightening feedstock supply. Numerous maintenance turnarounds already in progress and those that will be added from mid-April will further limit the volume of styrene available to ortho resins producers. Altogether, close to 2m t of capacity will be missing from the market. The only reason this did not play a role in March was because demand in the period leading up to the Easter holidays declined to a corresponding degree.

For April and May, converters will have to brace for a jolt. If at first look it seemed as though producers were asking for too much, the renewed rise in the styrene contract – nearly EUR 200/t within two months – means the supply side may well be able to push through a large part of this cost rise. At the same time, notations for other starting materials are also pointing upward: While maleic acid anhydride could still roll over, phthalic acid anhydride could rise again after a dip in March. The propylene contract (to feed monopropylene glycol) rose by a slight EUR 60/t in April. An extenuating factor in the price forecast is that converters’ inventories are quite empty as demand for their products was relatively weak at the beginning of the year.

Notations for all three glass fibre products covered in this report remained unchanged in March. For April, some niche direct roving products could see a slight upward trend.

To read the entire report, go to www.pieweb.com